The German startup ecosystem has stood out on the European market not only for innovation’s high level but also for the great financing offers in the region. The biggest hub, Berlin, offers EUR 1.2 million as a median seed round and EUR 7.3 million as a median series A round, while the global averages are EUR 603 thousand and EUR 3.3 million respectively. ¹

The majority of German startups are in the early development phase (seed and startup stage). In 2020, this number reached 73.1%, showing the importance of having a well-structured financing framework to ensure that any initial venture has access to capital. ²

This access to external capital is one of the main problems faced by entrepreneurs and startups in the first stages of their business’ development. Collateral and strong cash flow are still required in traditional financing processes although they don’t take part in startups’ reality.

In this context, the alternative financing market has grown very expressively, promoting early-stage businesses and showing its relevance in keeping the entrepreneurial ecosystem, especially in crisis time. The German crowdinvesting market achieved, in 2020, a volume of EUR 400 million, and almost half of this value represents institutional investors. ³

This means that crowdinvesting has the potential to help fill the funding gap because it allows not only nonqualified individuals to invest in innovative startups as well, but also represents a valuable first step in attracting the attention of larger investors. It is really interesting how the combination of different market agents can build more efficient structures to raise capital.

Considering that business angel and venture capital investments are among the favorite funding sources for German startups, behind only the government funding ², it is possible to see some german crowdinvesting platforms also innovate in bringing those professionals and their expertise as an opportunity to improve the traditional fundraising process.

The Bundesverband Crowdfunding e. V. (BVCF) is the central representation of interests and the network of commercial crowdfunding platforms in Germany. It was founded in 2015 in Frankfurt am Main and is based in Berlin. The crowdinvesting platforms jointly articulate their interests in relation to politics in Europe, Germany and the federal states.

Business Angel Market

Since the 1990s, Germany has developed a strong and diverse business angel market, consisting of a varied landscape of regional business angel networks as well as individual, informal angel investors. As a national federation, Business Angels Netzwerk Deutschland e. V. (BAND), founded in 1998, serves as the representative of the whole business angel scene.

Nowadays, business angels in Germany are widely recognized as the most important early-stage investors. This is particularly the case in the seed phase, where angels invest more capital than private venture capital firms. On top of that, more and more angels begin to invest in follow-on rounds.

Today, angel investing in Germany can be considered a lively market segment along the financing chain of innovative, high-potential startups. According to a 2019 evaluation by ExpertConsult, Germany has between 10,000 and 12,000 business angels and this group invested expressive amounts in 2020. ⁴

Besides that, Germany has a history and a variety of instruments and funds for public venture capital, with the High-Tech-Gründerfonds and several regional seed funds providing public money to innovative startups. Even if many of these funds actively incorporate business angels as lead or co-investors, a specific policy instrument to foster business angel investments remained an aspiration for quite some time.

With the establishment of the INVEST grant, the business angels scene not only received recognition by policy-makers but also concrete instruments to facilitate angel investments were introduced. ⁵

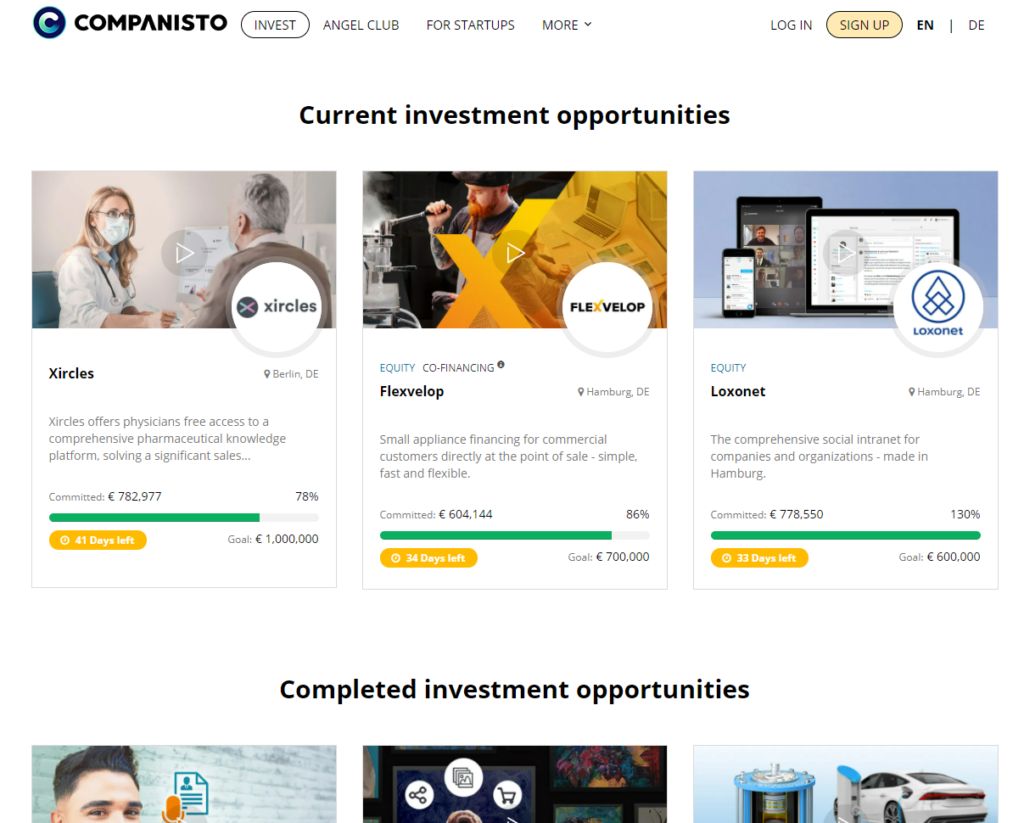

Companisto Case

Companisto, Germany’s largest investor network for startups and growth companies, was founded in 2012 by David Rhotert and Tamo Zwinge in Berlin. The crowdinvesting platform has almost 110,000 user accounts and EUR 106 million invested through 182 financing rounds.

Although its operating market is focused on Germany, Austria and Switzerland, the company has investors from 92 different countries. In 2018, it started a private group inside the platform called “Companisto Angel Club” that brings together financially strong investors and angel investors for the crowdfunding environment.

This group of people deals strategically with the topic of financial investments and is looking for professional access to equity investments in interesting startups. Members have the opportunity to participate in closed financing rounds at preferential rates and take advantage of the state INVEST grant, where 20% of the investment amount is reimbursed. In terms of volume and numbers of issued grants, Companisto has 6.5% of this market’s participation.

Any new opportunity that is offered on Companisto’s platform, can be firstly financed by this private group before going to the general crowd. This possibility increases the campaign success rate and allows the nonqualified investors to have examples to inspire themselves financing.

More than 15% of the total raised by the platform represents this group’s investment and the expressive participation is largely the result of the great networking built between its members. Besides all interactions that are possible using the platform, experts from different areas can also help to analyze new offers and cooperate with invested companies. Companisto’s community is an example of crowd power mixed with expertise from angel investors.

INVEST GRANT – 20% of the investment back

In order to address the financing gap problem in the German business market, estimated at EUR 859 million, the Federal Ministry of Economic Affairs and Energy (BMWi) created in May 2013 the program called INVEST. It was revised in 2017, and nowadays it consists of two grants: an acquisition and an exit grant.

The program is focused on business angels on the side of the investors and young innovative startups on the side of the companies.

Business angels need to invest at least EUR 10,000 and stay in the investment for 3 years to receive a fund of 20% of their investment, known as an acquisition grant. After 3 years, if the investors sell the company’s shares and get profit, they can apply for the exit grant and have the taxes on profits reimbursed.

The two main goals of this program are to encourage existing and new business angels to make or expand investments, and as a result, facilitating access to venture capital especially for young companies.

To participate in the program, companies need to submit an online application at the Federal Office of Economics and Export Control (BAFA). If all requirements are met, the company receives an eligibility certificate and will be listed in the INVEST database in order to be visible to potential investors.

On the other hand, investors need to submit an online application at BAFA before the conclusion of the participation agreement between them and the company in order to receive the grant. ⁶

Results

Besides the important function in the angel scene, the program contributes to raising public awareness of the concept of business angel and makes this form of capital allocation more popular. The effects can be noticed in companies, investors and in the entrepreneurial ecosystem as a whole.

Almost a quarter of the companies would probably not have been established without INVEST support, or possibly would have been significantly delayed. The quicker success in the search for investors and also some impacts brought by additional capital such as faster implementation, early market entry, time advantage in development and others can be highlighted as program’s benefits.

In 2017 and 2018, the average of different investors exceeded the government target, reaching the number of 1,400 business angels. Each investor usually participates 4.5 times in the program, which means more capital coming into this market, and although the minimal possible investment is EUR 10,000, the average subsidized investment is EUR 81,700.

The program already mobilized EUR 910 million through almost 11,400 investments. At least 16% of the total angels in Germany have been reached by the program so far. 32,000 jobs were created and 8,000 jobs would not have been created without the program. ⁴

Outlook

It’s really interesting to think about all the possible effects created by the program if it were extended to other types of investors. In 2020, more than EUR 400 million was invested by german investors via crowdinvesting platforms.

Despite the fact that the corona pandemic led to uncertainty among investors, the market development in the 3rd and 4th quarters of 2020 and in the first quarter of 2021 shows that the interest in crowdinvesting is still great. The level of 2019 was reached again in the first quarter of 2021. ³

Would be great if the INVEST was accessible to crowdinvestors, with a lower value for minimum investments, and contemplated other instruments such as subordinated loans, which is the most used instrument on platforms, and not only the equity model.

Venture Capital Market

In terms of venture funding, Germany saw an all-time high in 2019, with a 50% increase over 2018. Companies received EUR 2,256 million in funding across 664 deals. These results made Germany continue to be the 2nd best-funded country in Europe behind only the UK. ⁷

Although the numbers dropped in 2020 largely due to the effects of the Corona pandemic, this market raised EUR 1,850 million, 74.7% of which invested in seed and startup-phase companies. The massive concentration of investments in the early-stage phase has grown over time, proving to be a good strategy for maintaining startups and SMEs, especially in time crises. ⁸

As the deal number remains at the same level, average investment tickets increase every year, showing a mature ecosystem that has the highest valuations in Europe. A pre-money German valuation corresponds to EUR 6.1 million in seed phase, EUR 22 million in Series A and EUR 100 million in Series B. ⁷

The geographically decentralized ecosystem enables Germany to be home to specialized and complementary hubs that cover expansive ground and form a well-connected city network that extends even by the DACH (Deutschland, Austria, and Confederation Helvetica – Switzerland) region.

Despite the fact that Berlin has the highest percentage in venture capital investment, 39% of the total German offers, other cities and regions have also good representativeness in this topic. Munich and Hamburg have 28.8% and 22.1% respectively, both performing above the national average of 18.6%. ²

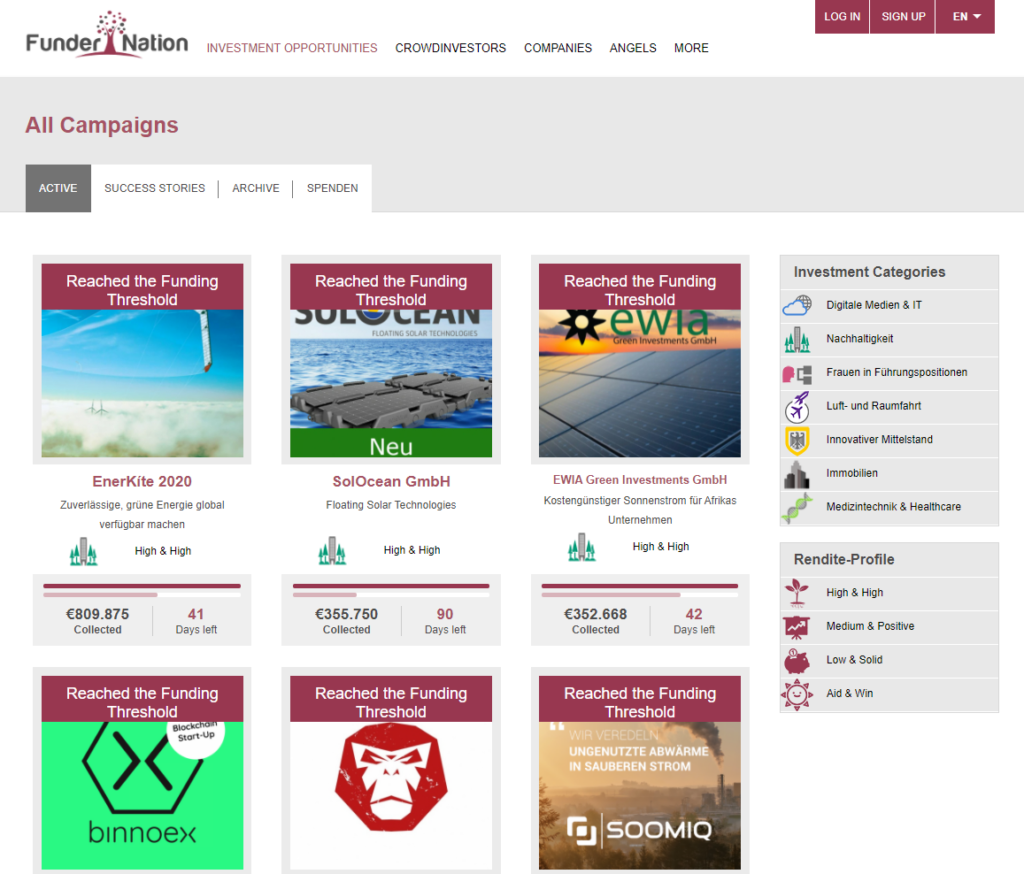

FunderNation Case

FunderNation, Germany’s first crowdinvesting platform set up by an experienced venture capital team, was founded in 2014 by Uli W. Fricke in Bensheim-Auerbach. Offers are focused on IT, Greentech, Healthcare & MedTech and Aerospace, and these categories are largely a reflection of Triangle Venture Capital Group (TVCG) business model since it creates outstanding and highly innovative companies from research spin-offs.

The idea to found a crowdinvesting platform was driven by a market need when the TVCG identified, in the first half of the 2010s, that the venture capital market, in Europe, didn’t grow as fast as the startup ecosystem. There were many more companies looking for capital than professional investors acting in this business. It was clear that not only an alternative way to raise money but also different sources of capital should be introduced in the market.

FunderNation was created in order to organize efficient fundraising from private investors through an online platform, offering an opportunity to those companies that would be eligible to receive investment but had not yet obtained it.

Seventeen years of high-tech investment experience were hugely helpful to build a successful business. How and what to look for in companies, what looks great but doesn’t work, how much work is necessary to help companies to become successful, the prevailing funding structures of startups across the world, the expectations of business angel and VC investors when they look at startups, the legal and regulatory frameworks, all this know-how contributed to creating a platform with important investing background.

Symbiotic relationships between crowdfunding platforms and venture capital firms can offer a longer business development path to startups than just performing their earliest investment rounds. With transparent procedures and rules of co-investment, FunderNation is in the process of raising the next generation of venture capital funds.

In a vibrant startup ecosystem, it is critical that crowdinvesting platforms, business angel investors and VC investors can work together and co-existing to bring different solutions to distinct companies. Very few agents in this market can run a company from one to IPO without anybody else providing additional funding. Therefore it is evident that only one category of investors is not feasible for market development.

“Not every startup wants to be a unicorn. Not every entrepreneur wants to be driven to an exit and sell the company after 5 years, which is what the VC investor needs”, emphasizes Uli. Crowdinvestors and business angel investors, that usually don’t have such aggressive money flow demand, can subsidize startups without a business plan or an intention to grow 100 times in a short period of some years. Mobilizing private capital to be invested in young and innovative companies is imperative to get the economy out of the covid-crisis.

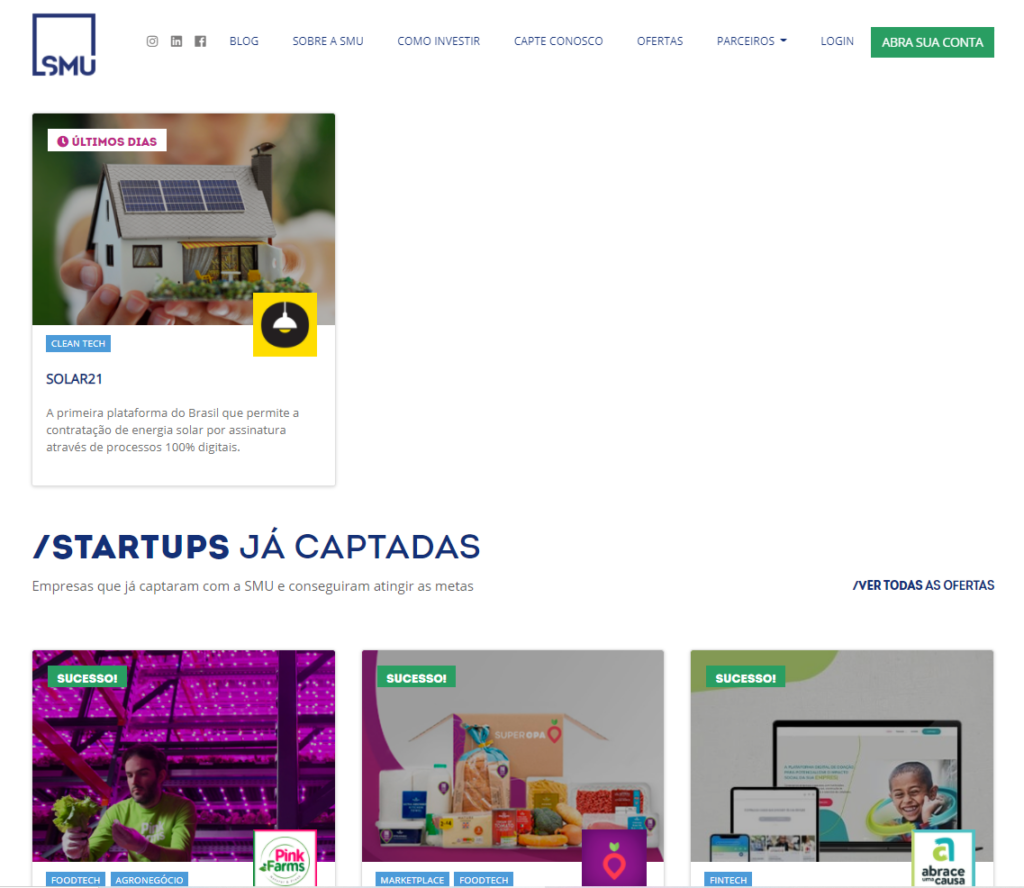

SMU Case – the Brazilian market

The relationship between angel, crowd and venture capital investors can also be observed in the Brazilian market. The crowdfunding regulation introduced the figure of the investment syndicate and the leading investor into the crowd market, allowing this person, which can also be a company, to lead an offer through a crowdinvesting platform. ⁹

In general, business angels, qualified and corporate investors assume the offer leader position, contributing at least 5% of the funding round. Besides the capital, the investment syndicate brings more security to all investors once the financed company has been analyzed by professionals that are mostly segment experts.

There are several obligations involved in the leading investor position such as, for example, presenting his/her investment thesis setting out the reasons and justifications for such a choice besides having a centralized communication with the goal to decrease information asymmetry.

On the other hand, the regulation allows a performance fee payment to the leader based on the investment return measured in the exit, including through securities issued by the small business company. This is a great incentive to put together different agents to interact and to participate over a crowdfunding framework. Business angels and especially corporate investors started to see this model as a possible option to structure a fundraising process.

SMU, Brazilian’s first crowdinvesting platform founded in 2013 by Rodrigo Carneiro, Diego Perez, Fabio Silva and Fernando Patucci, acts as a leading investor in all offers that are raising funds on its platform. This business design shows a strong platform alignment with its investors, confirming by the skin-in-the-game strategy that the platform is more than just a marketplace.

Commitments in this level positively impact all platform processes from the search and analysis of the startup to the post-investment. “This model makes us smarter in our analysis, we want the startups’ success and the investor return. The exit is our goal and we understand that this interest’s line is good for all involved, platform, investors and entrepreneurs ”, comments Rodrigo.

Other two different models can be found in the Brazilian market. When the platform considers the startup its main client, instead of the investors, it acts as a marketplace that offers its customer basis and provides all the crowdinvest services. When the service is just offering a technological solution to big players, we have a PAAS (Platform as a Service) where the client can customize it with its brand and set up all its campaigns.

The complementary between the market agents has become expressive and successful in many funding rounds. Joining forces and raising funds together is a good plan to provide a more assertive growth cycle to startups. SMU has partnerships with agents that are raising in earlier stages than crowdinvesting, like angels, groups of angels, accelerators, incubators, and also with agents from following rounds, like venture capitalists. “I talk with big funds to know what they want to see and what they don’t want to see in their rounds. Then, I apply the reverse engineering in our offers to increase the chances of these startups continuing their path in fundraising”, adds Rodrigo.

Understanding the ecosystem as a whole, not just worrying about your own business, shows us a more mature market and an environment conducive to successful cases.

Rodrigo believes in a future where all players use the crowdfunding framework to raise capital. The regulatory strength and the crowd power can bring benefits that do not exist in other models. The secondary market development, which was proposed by SMU via regulatory sandbox and is being analyzed by the Brazilian regulator, CVM (Securities and Exchange Commission), will start a new era in crowdinvestment and the other agents will be able to take advantage of this necessary market evolution.

Do you want to know more about alternative financing and the entrepreneurial ecosystem? Find out about my research in Germany HERE, and don’t miss the next chapters of this series on the German and Brazilian markets.

Fonts

¹ Startup Genome. The Global Startup Ecosystem Report 2020 (GSER2020): https://startupgenome.com/reports/gser2020

² Bundesverband Deutsche Startups e.V.. Deutscher Startup Monitor 2020: https://deutscherstartupmonitor.de/wp-content/uploads/2020/09/dsm_2020.pdf

³ BVCF Site: https://www.bundesverband-crowdfunding.de/2021/04/pressemitteilung-marktdaten-2020/

⁴ ExpertConsult. Evaluation of the funding programme “INVEST – Venture capital grant”: https://www.bmwi.de/Redaktion/EN/Downloads/E/evaluierung-des-foerderprogrammes-invest-executive-summary.pdf?__blob=publicationFile&v=2

⁵ BAF – Business Angel Funding. Understanding the Nature and Impact of the business angels in Funding Research and Innovation: https://www.business-angels.de/wp-content/uploads/2017/12/Final-Report_Understanding-the-Nature-and-Impact-of-the-business-angels-in-Funding-Research-and-Innovation_FV_Formatted_Revised1.12.2017.pdf

⁶ BMWi Site: https://www.bmwi.de/Redaktion/DE/Dossier/invest.html

⁷ White Star Capital. German Venture Capital Landscape 2020: https://medium.com/venture-beyond/diving-into-germanys-venture-capital-landscape-in-2020-291cf4b86f2

⁸ BVK. Der deutsche Beteiligungskapitalmarkt 2020: https://www.bvkap.de/sites/default/files/page/20210315_bvk-statistik_2020_vorlaeufig_in_charts_final_0.pdf

⁹ CVM. ICVM 588: http://conteudo.cvm.gov.br/legislacao/instrucoes/inst588.html

0 Comments